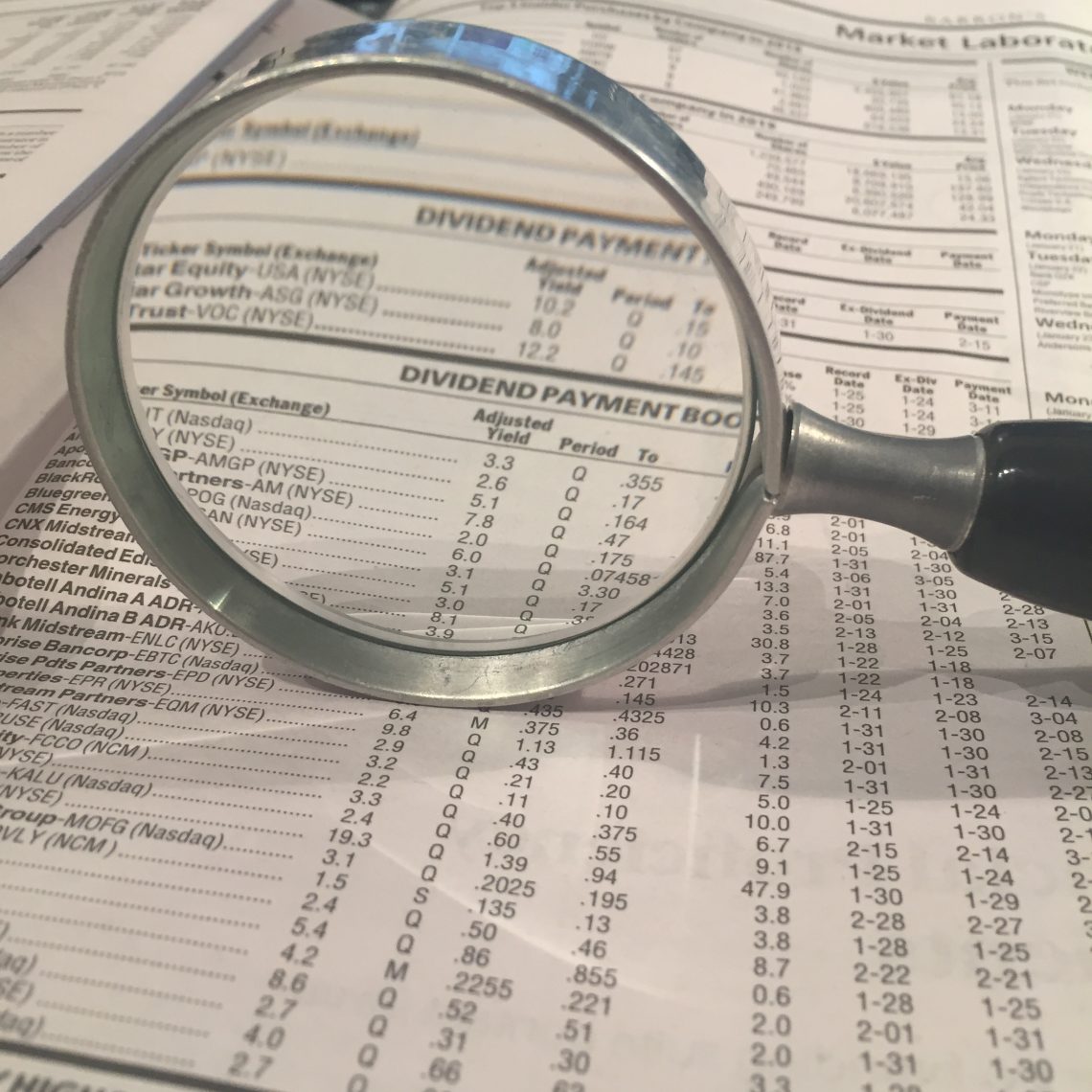

If you are new to investing, one topic that often comes up is dividends. But what is a dividend, and why should you care about them? Where do they come from? Why are some higher than others? Should you only invest in companies that pay dividends? Lets take a look at how dividends work.

`

Companies exist to earn a profit for their shareholders. When you buy a share of stock, you become a fractional owner of the business. As part owner of the business, you are entitled to a proportional fraction of what the company makes in profits. Now does that mean you get all the money earned by your share in the company every year? No, not quite, but you might get some of the money, depending on how the board of directors feels about distributing some of the company cash. The board of directors, elected by the shareholders, determines the best way to use the money earned by the company. They have several options to choose from when deciding where this money should go. Lets take a look at some of the options.

How can a company spend it’s earnings?

First the company will see if there are any internal needs within the business. Maybe some machines need replaced, or other internal investments need to be made to grow the business, and thus the earnings of the business. A business will look at the returns they can make on these investment opportunities, and determine if the return is high enough to warrant the investment. If the company can invest internally and get a 20% rate of return, they would be nuts to do just about anything else with the money. In this case, you would not want the company paying you any dividend, but instead investing every penny in this high return opportunity.

Now most businesses do not have the option to invest at very high rates, like 20%, or if they do, the opportunity is likely limited in the amount of money they can invest. In that case they have a few other options. They can use the money to buy back their own shares, save the money (or invest it in some other security), or they may choose to pay a dividend and return some of the cash to the shareholders of the business. In practice, most businesses do some combination of all of the above depending on the opportunities the company has available.

When a dividend is paid, the cash moves from the company to the shareholders. It shows up in your brokerage account a few days after the company makes the dividend payment. Companies pay dividends at different intervals. Some pay monthly, while others pay quarterly, semi- annually, or even annually. It all depends on the company and how the board choose to set their dividend policy. A few companies even pay what are known as special dividends. These are more irregular and not as predictable as normal dividend. I talk more about special dividends here in my post about Stealth Dividends.

One common misconception among new investors is that the dividend does not have any impact on the price of a share. The reality is that the share price is adjusted downward at market open the day the dividend is paid. The price movement is often not noticed by investors as the dollar amounts are quite small relative to the daily fluctuation of the stock. Value is not created out of thin air.

I once had a co-worker who was dead set on trying to collect large dividends and found a company in liquidation that was planning on paying a dividend of half their current share price. His plan was to buy the shares, collect the dividend and sell the shares at the pre-dividend price. He quickly found out that this is not how things work. The share price was adjusted down by the dividend amount prior to the start of trading and he never had the chance to sell at the pre-dividend price.

So how should you think about dividends? They are best viewed as just one part of the total return you should expect from an investment. They should not be something you chase, or search out all by themselves. If a company is attractively priced and pays a dividend, great! If not, they likely have better, higher return uses for the money internally, which is not necessarily a bad thing. Another thing to watch out for is when the dividend yield is unusually high. This can be a sign of trouble in a company. It may indicate that investors are expecting a cut or elimination of the dividend altogether. It may also signal that the company is under financial pressure of one sort or another.

A Dividend Can Be Cut

A recent example of a dividend cut would be what happened to Conoco Phillips in 2016. When the price of oil crashed, Conoco slashed its quarterly dividend from $0.74 per share to $0.25 per share. The shares at one point sported a dividend yield of over 6.5%, prior to the cut. This was after a steep price drop of over 45%. Investors thinking they could get a high yield were sorely disappointed when the company reduced the dividend to $1 a year, or 2.9%. Purchasers of COP shares after the dividend cut still made out okay. The shares have doubled in price since that time and the quarterly dividend has grown slightly to $0.285 per share.

The dividend yield, as calculated by the current annual dividend amount divided by the current share price, varies across companies and industries. Why the difference? A lot of it comes down to growth prospects and risk. If a company is not forecasted to grow at a rapid rate, the dividend yield will be higher to compensate for the lack of share price appreciation. Investors will also look at the risk associated with a stock and demand a higher dividend to compensate for this risk. Oil companies typically have higher dividend yields to compensate for the cyclical nature of their business.

Total Return – The Only Number That Matters

So, witch to choose, high or low yield or even no yield? Well, in a perfect world, where all stocks were priced perfectly, all these investments would end up delivering the same return. This ideal world does not exist and there are wide ranges of returns over time. It is the job of the investor to try and figure out what shares are undervalued. This is precisely why it is so important to look at the total return vs. just a dividend amount. While the dividend might be attractive, the total return might not be quite as high as something that is growing rapidly but with a lower dividend. It is always nice to get cash handed to you, but the real key to market beating returns is to look at the total return, not just the dividend.