Some companies pay regular, predictable dividends on a monthly, quarterly or annual basis. Most companies usually stick to quarterly payments, but there are some exceptions out there. But what about companies that do not declare regular dividends, but instead opt for “special dividends”. These do not show up in screeners or on finance sites as part of the dividend yield as they are irregular payments without the expectation of recurring.

But some companies pay these special dividends very regularly. If a company pays a “special” dividend every year, in a sense it – almost- becomes a regular dividend. This leads to me calling these “stealth” dividends. Why stealth? Because almost all the finance sites don’t include these dividends in their yield calculations.

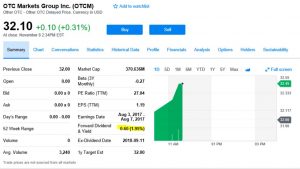

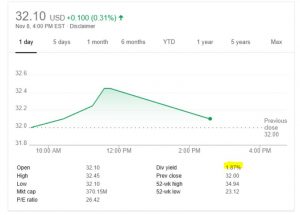

So what is the big deal? Well, this dividend can often be a meaningful part of the total return you get from a stock. Take OTC Markets Group Inc. (OTCM) for example. The current quarterly dividend is $0.15 or $0.60 annually for a yield of just under 2% (share price of $32 at the time of this writing). However, if you view the historical dividend payments from OTCM, they have made an extra $0.60 payment for the past 3 years in November. That just doubled the yield on your OTCM position to just under 4%. Even better, this year they increased their special dividend to $0.65, for a total of $1.25 for the year, a yield of 3.9%. Take a look at the results from Yahoo Finance, and Google Finance below. Both do not include the special dividend amounts. This is another reason I never rely on the statistics posted on Yahoo or Google. For more on this topic see my post on Doing Your Own Homework.

OTCM on Yahoo Finance

OTCM on Google Finance

Another company that declares special dividends is Amerco (UHAL). They actually do not pay a regular dividend, but only pay special dividends. At first glance, they appear to not be a dividend paying company, but looking at their dividend history shows otherwise. They started paying a special dividend in 2014, in varying amounts, shown below.

2018 – $2.50

2017 – $2.00

2016 – $4.00

2015 – $2.00

2014 – $1.00

The dividends listed above demonstrate one of the downsides of special dividends. Companies are not committed to making these as regular payments, so there can be a high degree if irregularity to the amounts and timing. I am okay with irregularity in investing. It can create opportunity for those who can accept traveling down a bumpy and unpredictable road.

I’ve started a list of companies that pay special dividends with some regularity. I plan on updating this list as I come across more. The below companies have all paid special dividends for the past 3 years or more.

Special Dividend Paying Companies

OTC Markets Group Inc. (OTCM)

Amerco (UHAL)

National Presto Industries, Inc. (NPK)

Diamond Hill Investment Group Inc. (DHIL)

National Beverage Corp. (FIZZ)

We own shares of OTCM, FIZZ and UHAL.