One of the more popular posts on this blog is about shareholder perks. I wanted to take a deeper dive into one perk I uncovered and see what it would take to get the free chocolate that is given to shareholders of Lindt. Each year at the annual meeting, shareholders receive the box of chocolate as shown in the pictures. Lindt has 2 classes of shares, registered shares and participation certificates. So what do these share classes mean? And which class gets the free chocolates? The registered shares trade in the U.S. on the OTC market under the ticker COCXF. The participation certificates trade the same way under the ticker…

-

-

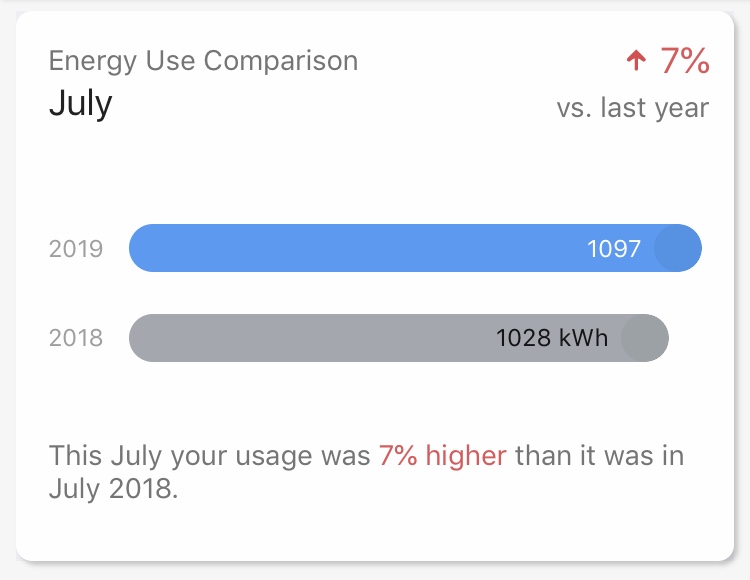

Insulation Results – July

Well, this is disappointing. Our July electrical usage was 7% higher than the previous year. What is happening? I thought insulation was supposed to reduce our energy usage! Taking a closer look reveals our insulation was still working, but we had some very warm weather in July. Below is a map from The National Climate Report showing July 2019 vs the average from 1895 to today. The National Climate Report also had this to say: ” Some of the warmest areas were across Ohio, northern Illinois and southern Wisconsin. Minimum temperatures were very warm across the region. Of the more than 400 daily high temperature records broken or…

-

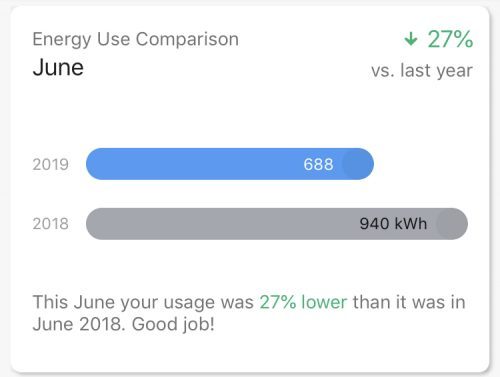

Insulation Results – June

Well, our first full month of having insulation is now over and the results are in. Lets take a look at our electricity bill in June 2019 vs June 2018. The below is a screenshot from the It’s Your Power App from AEP. So we used 27% less electricity vs last year! Not bad at all, especially since this is the summer and the temperature difference between outside and inside is much less than in the winter. We would expect to see an even larger impact this winter, but we will have to wait and see. Overall we used 688 kWh of electricity vs 940 kWh last year. Clearly a large…

-

The Energy Audit – Saving Through Energy Efficiency

Late last year we started to look into how much energy we were using. The bills seemed high, but it was hard to quantify exactly how much we could save by air sealing and insulating. Our local natural gas utility was offering an energy audit for only $25. The normal price of an audit is closer to $300-$500, so this was quite a bargain. We decided to take the plunge and delve deeper into the efficiency of our home. Improving the energy efficiency of your home can be a great way to save money. This will be the first post in a series detailing the steps we took to update the energy efficiency…

-

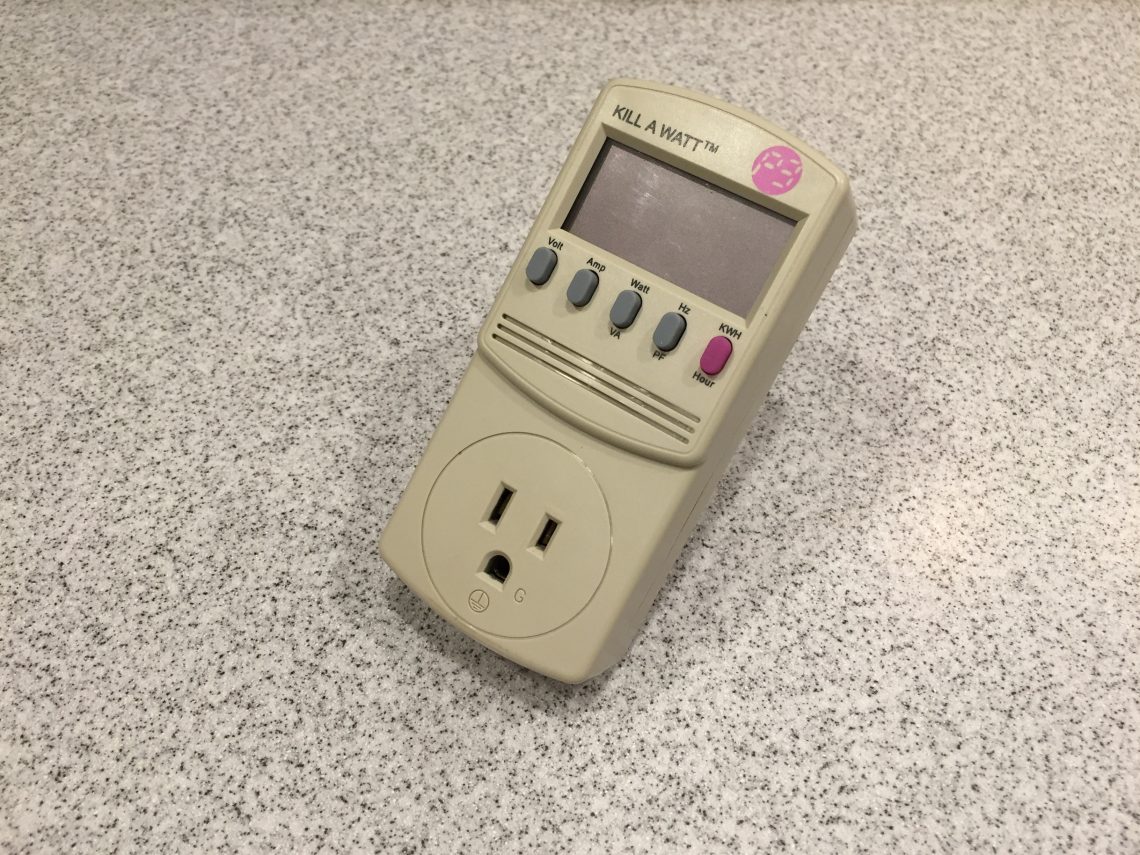

Phantom Loads

Phantom loads, parasitic power, vampire power, so many names for the same thing; your electrical devices slowly making you poorer! These terms all refer to the power drawn by electrical devices that are plugged in but not being used, yet still drawing power. Think of power supplies plugged into the wall, computers, TVs, kitchen appliances, fire alarms, and garage door openers. All of these draw some power, even when not being used. Some items can draw considerable standby power that really adds up. This article will detail our process for tracking down and taming electrical gremlins. AEP Power Bridge and Kill A Watt Meter Our interest in this topic all started after attending a fair…

-

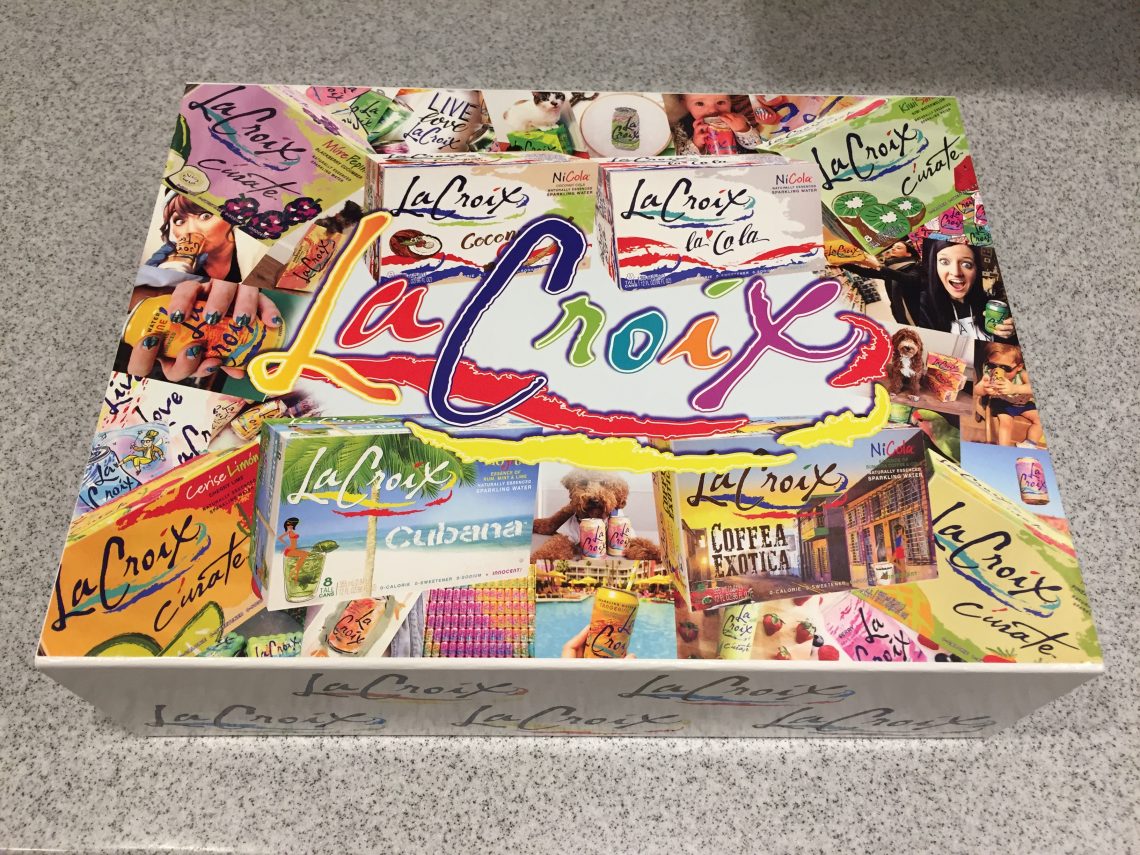

The Perks of Being a Shareholder -The Mystery Package

One of the fun things about being a shareholder is that some companies give free perks. I started tracking companies that provide an extra benefit to being a shareholder. (See my list below.) We purchased some shares of National Beverage (FIZZ) earlier this year and were quite surprised when this unexpected 7lb box showed up on our door step. Unexpected Gift from LaCroix The UPS driver was pulling up to our house right as we were both in the kitchen cooking dinner. Neither of us had any idea what he could be delivering. Once I saw the National Beverage logo on the side, I was intrigued. I was hoping it…

-

Our Mortgage Battle

One debt that most people accumulate in their lives is a mortgage. A few fortunate souls out there might be able to plunk down the purchase price of a house in cash, but we were not among that group! This article will detail exactly how we plan on tackling our mortgage, with the expectation that we pay it off early. One topic that is hotly debated is weather it is better to invest extra money, or to pay down low interest rate debt. This was a topic we have been torn over for quite some time. When I say torn, I don’t mean that Sam and I disagreed. Exactly the opposite,…

-

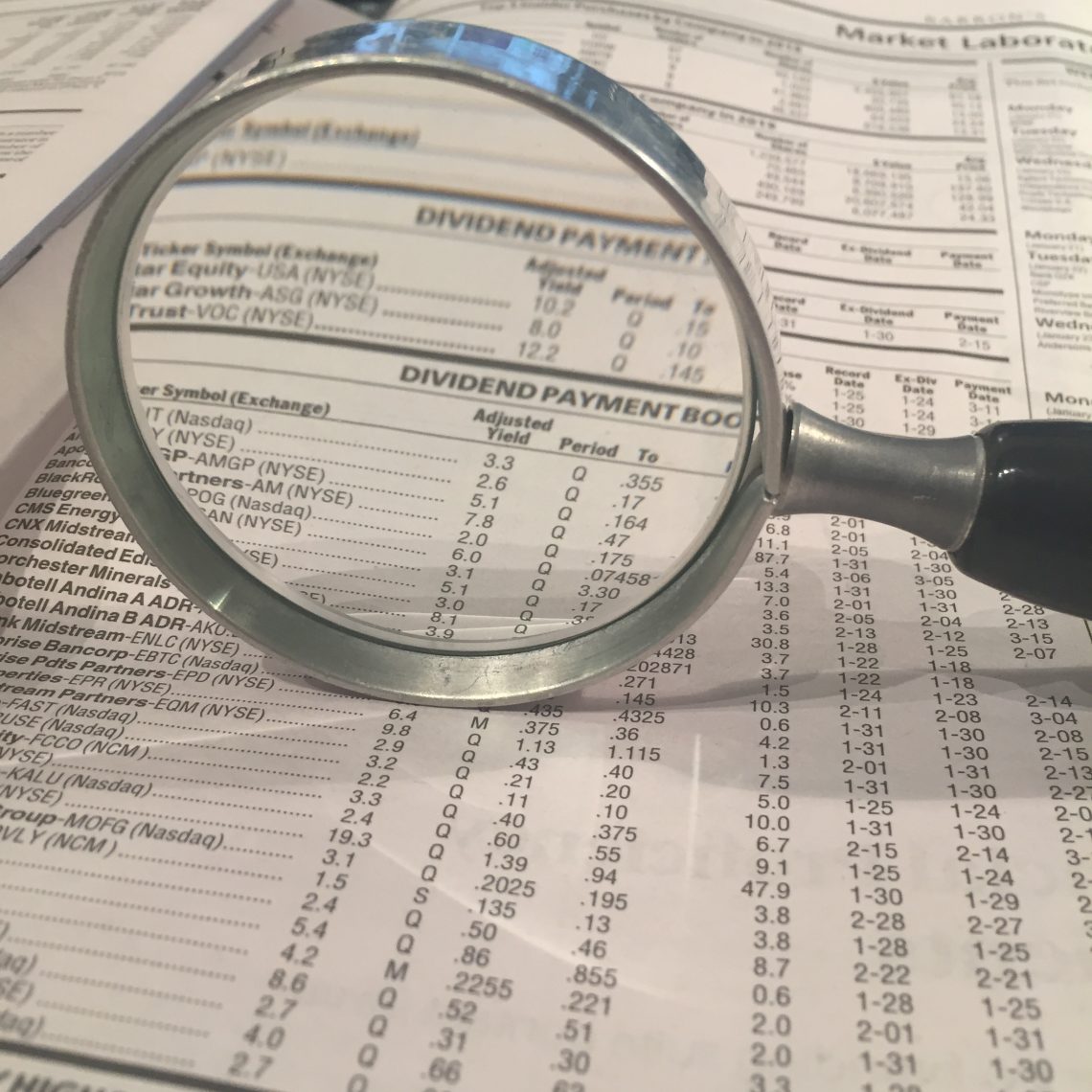

What is a dividend anyway?

If you are new to investing, one topic that often comes up is dividends. But what is a dividend, and why should you care about them? Where do they come from? Why are some higher than others? Should you only invest in companies that pay dividends? Lets take a look at how dividends work. ` Companies exist to earn a profit for their shareholders. When you buy a share of stock, you become a fractional owner of the business. As part owner of the business, you are entitled to a proportional fraction of what the company makes in profits. Now does that mean you get all the money earned by…

-

Stealth Dividends

Some companies pay regular, predictable dividends on a monthly, quarterly or annual basis. Most companies usually stick to quarterly payments, but there are some exceptions out there. But what about companies that do not declare regular dividends, but instead opt for “special dividends”. These do not show up in screeners or on finance sites as part of the dividend yield as they are irregular payments without the expectation of recurring. But some companies pay these special dividends very regularly. If a company pays a “special” dividend every year, in a sense it – almost- becomes a regular dividend. This leads to me calling these “stealth” dividends. Why stealth? Because almost all the…

-

How We Got Free Trades for 15 Years

Recently, our longtime broker, Scottrade, was acquired by TD Ameritrade. The transition was smooth and uneventful. All our positions transferred over and I have not experienced any disruptions because of the change. I initially had no intention of switching brokers, but a deal popped up that was too good to pass up. Charles Schwab is offering a “tenure trade offer” to all former Scottrade account holders. They will give you free trades for as long as you have been a Scottrade customer. Initially I though it went something along the lines of , if you were a customer for 5 years, you got 5 free trades. This is not the case. If you were with Scottrade for…